Invest in your Financial Future with New Life Assisted Living

What are we About?

New Life Assisted Living is the premiere franchise business in the Assisted Living Services industry. Only the most qualified individuals, who prove they can meet and exceed the expectations of our clients, are hired to provide care. New Life Assisted Living thrives today to offer quality senior living at affordable prices.

What makes New Life Assisted Living Different?

Why Now, Why This Model?

All Baby Boomers are 65+ by 2030. That’s the structural shift that expands the senior market across the 2030s.

Census.gov

1 in 5 Americans will be 65+ in 2030 (~71M people). Multiple projections converge around ~20–21% of the population.

Cooper CenterCensus.gov

By 2035, older adults outnumber kids. The Census projects ~78 million people age 65+ vs ~76–77 million under 18—an inflection that sustains demand beyond 2030.

AARPArkansas State Data Center

The 85+ population nearly doubles by 2035. From ~6.5M to ~11.8M—the cohort most likely to need help with ADLs and supportive housing.

Census.gov

Households headed by 65+ drive housing demand through 2035. Harvard JCHS projects ~92% of net household growth (2025–2035) will be 65+, with the greatest surge among 80+ households.

Harvard Joint Center for Housing Studies

Context today: The 65+ population grew to ~61.2M in 2024 (and is still rising), with many states already seeing more older adults than children – evidence the shift is underway now.

Home Care vs. Assisted Living

Gaps & Cost Comparison

Home Care

Assisted Living

Staffing & Supervision

One-on-one caregivers, but usually limited to the scheduled hours.

Supervision gaps when aides leave; family often must fill in.

High caregiver turnover disrupts continuity.

24/7 trained staff on site.

Supervision, meals, and care integrated seamlessly.

Backup staff if one calls out—no coverage gap.

Socialization & Quality of Life

Client may remain isolated at home unless family arranges outings.

Social stimulation depends on aide initiative.

Built-in activities, peer community, shared meals, group exercise, and outings.

Proven to reduce depression and cognitive decline compared to isolation at home.

Safety & Environment

Most homes are not designed for fall prevention, dementia safety, or wheelchair access.

Families must pay out of pocket for home modifications (ramps, grab bars, bathrooms).

Purpose-built for seniors (fall-resistant flooring, emergency call systems, ADA bathrooms).

Staff trained in fall prevention and rapid emergency response.

Care Coordination

Aides often not licensed for med management; family must manage prescriptions.

Communication gaps with doctors or hospitals.

Medication management, care plans, on-site nurse/medical oversight.

Established relationships with local physicians, hospitals, rehab, hospice.

Costs (National Averages, 2024–2025)

(varies by state — these are national median benchmarks from Genworth Cost of Care Survey & senior housing reports)

$30–$35/hour average → ~$6,600/month for 44 hours/week.

24/7 care at home: $20,000–$25,000/month.

$5,500–$6,000/month average.

Memory care units: $7,500–$8,000/month.

✅ Key Gap: At moderate care needs, assisted living is less expensive than full-time home care while providing more oversight, safety, and social benefits.

❌ Exception: If someone needs only a few hours of help per week, home care can be cheaper short-term.

With Us, You’re Family!

Proven Business Model

Established Brand

Supportive Franchisor

Moderate Initial Investment

Innovative Service

Highly Scalable

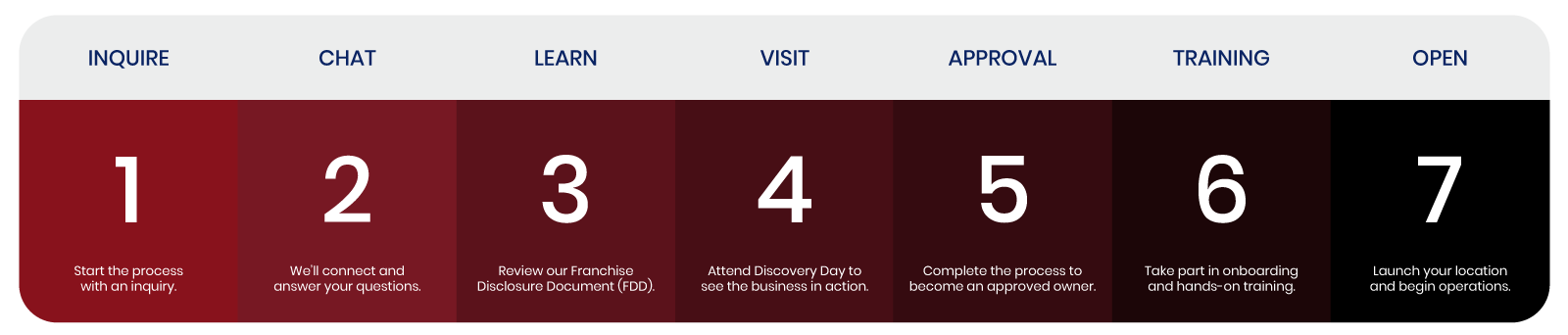

How it works

Steps to Ownership

Like any new relationship, the journey to becoming a New Life Franchise consists of a few stages, allowing both parties time to get to know one another before making any commitments.

Investment Details

Turn-key franchise opportunity

Expert support & resources

Franchise Fee: $35,000 for one unit

$65,000 for two units

$90,000 for three units

Royalty: 6% gross monthly sales

Marketing Fund: 1% gross monthly sales

Becoming a Franchisee

For more information about becoming a franchisee, feel free to fill out our contact form or give us a call at 443-364-8712.